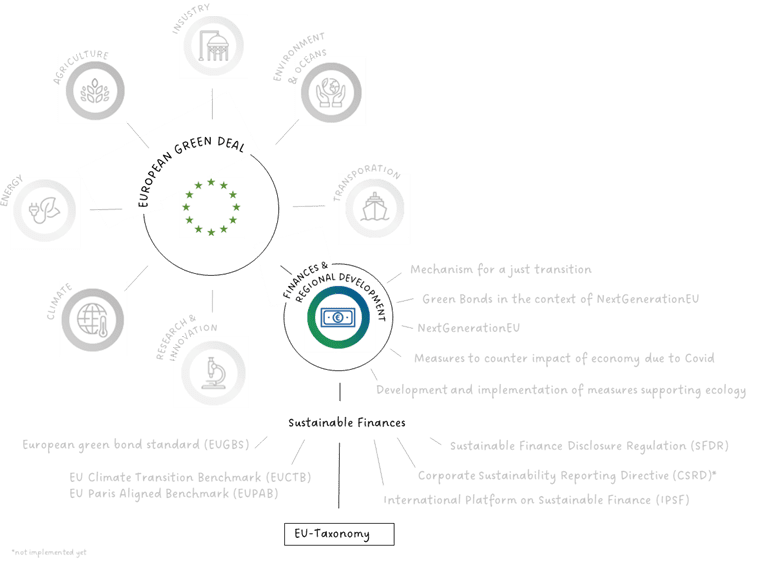

The EU-Taxonomy is part of the “European Green Deal” which aims to achieve climate neutrality in the European Union (EU) by 2050. This would eliminate all net greenhouse gas (GHG) emissions in the EU by 2050. The Green Deal brings together numerous measures in a wide range of areas. In the area of sustainable financing, the EU-Taxonomy aims to increase the volume of green investments, including buildings, needed to meet the objectives of the European Green Deal.

The EU-Taxonomy defines uniform criteria for economic activities that contribute to the EU’s environmental objectives including the real estate industry. Certain companies are required to disclose whether their business complies with EU-Taxonomy requirements. However, compliance with the taxonomy requirements is not mandatory. Rather, it is about creating transparency for investors so that they can make their investment decisions based on uniformly defined EU-Taxonomy criteria.

What is the impact of EU-Taxonomy?

The EU-Taxonomy provides clear criteria for the transition to a carbon-neutral and sustainable economy. Without clearly defined criteria, it is difficult for companies and investors to decide what is sustainable and what there is a risk. The following financial directives relate to EU-Taxonomy:

Corporate Sustainability Reporting Directive (CSRD): Companies that are required to publish CSRD reports must transparently disclose whether their economic activities are compliant with the EU-Taxonomy requirements. This directive will follow the previous NFRD (Non-Financial Reporting Directive) and has not yet entered into force.

Sustainable Finance Disclosure Regulation (SFDR): Where financial products are advertised as ”sustainable”, certain disclosure criteria apply. These are linked to the EU-Taxonomy. In addition, the following planned standards relate to EU-Taxonomy. However, a precise time frame for implementation is not yet available for all.

EU Green Bonds Standard (EUGBS): The EU is planning a voluntary standard for sustainable bonds. Publishers of green bonds may then use the funds exclusively for activities compliant with the EU-Taxonomy.

EU Climate Transition Benchmark (EU CTS) | EU Paris Aligned Benchmark (EU PAB): EU CTS and EU PAB are climate benchmarks for sustainable funds. The EU plans to link these to the EU-Taxonomy requirements in the future.

EU Ecolabel for Financial Products: The EU plans to extend the Ecolabel, which is already in place for cleaning products, electrical products, clothing and much more, to financial products. Standards will reference the EU-Taxonomy.

Other EU-Instruments: Other EU- or national Instruments may refer to the EU-Taxonomy, but they are not defined there. Examples are the ”Building and Resilience Facility“ to deal withCovid-19 or the research funding program “Horizon Europe”.

How does the EU-Taxonomy define sustainable economic activities?

To be considered taxonomically compliant, an economic activity must fulfill one of the following environmental objectives.

- Climate protection

- Adaption to climate change

- Sustainable use and protection of water (and marine resources)

- Transition to a circular economy

- Avoidance and prevention of pollution

- Protecting and restoring of biodiversity of ecosystems

Furthermore, none of the objectives must negatively impact others and minimum social standards and technical testing criteria must be complied with. So far (as of June 2022), only the environmental objectives (1) and (2) have been adopted, while (3) to (6) will follow in the future.

Which significance has the individual environmental targets for a building?

(1) Climate protection: The goal is to prevent or reduce GHG emissions into the atmosphere or to recover them. For buildings, this may mean planning a building so that the primary energy demand is below a defined reference value, conducting an airtightness test after completion, or conducting a life cycle analysis for the building.

(2) Adaption to climate change: The goal is to reduce current and future climate risks through adaptation strategies. For buildings, this may mean that current but also predicted heavy rain risks are analyzed at the site. Based on this, measures such as permeable areas on site will be designed accordingly. Ideally, these findings can be incorporated early in the design process.

(3) Sustainable use and protection of water and marine resources: The goal is to achieve or maintain good water quality in lakes, rivers, groundwater, and marine waters. For buildings, this may mean the use of low-flow fixtures or incorporating measures to avoid spills on construction sites.

(4) Transition to a circular economy: The goal is to move towards a circular economy through waste prevention, reuse, and recycling. For buildings, this may mean that a specific amount of construction and demolition waste is reused or recycled. In addition, buildings should be designed in an adaptable, flexible, and deconstructable way.

(5) Avoidance and prevention of pollution: The goal is to avoid emissions of pollutants into the air, water, and soil. This environmental target is not about GHG emissions, but about other harmful emissions that have an impact on human health and the environment. For buildings, this may mean that components or materials comply with defined limits (e.g., formaldehyde) or that sites are inspected for contaminated soil.

(6) Protecting and restoring biodiversity of ecosystems: The goal is to protect, conserve, or restore biodiversity. For buildings, this may mean that an environmental impact assessment is carried out and that agricultural and forest areas of particular value are not developed.

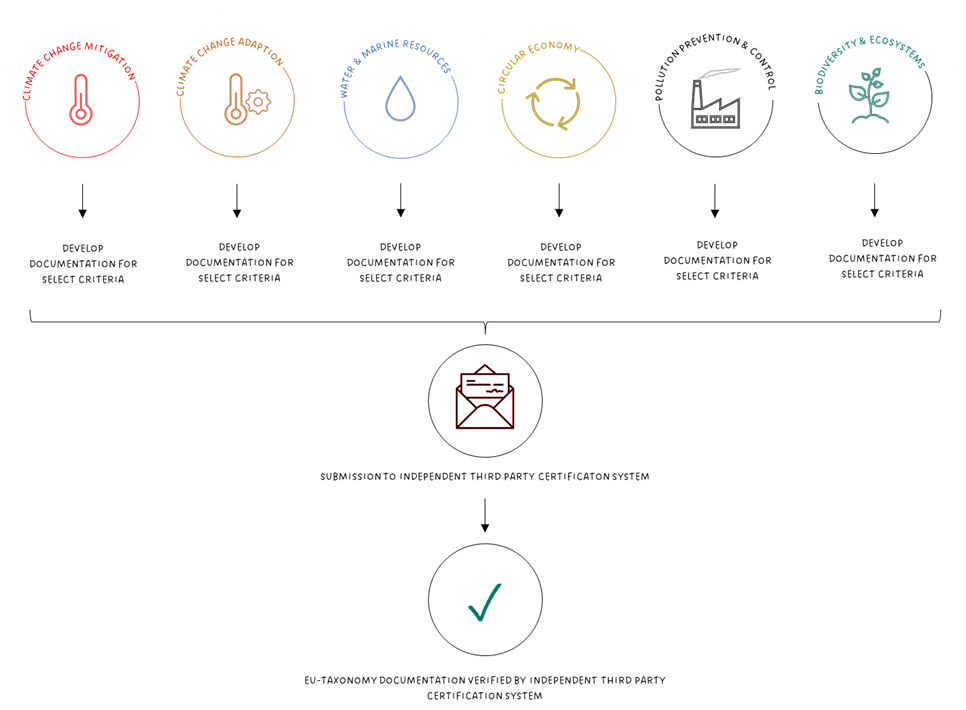

How can environmental objectives be demonstrated?

For buildings and portfolios, it is possible to prove compliance with the EU-Taxonomy via independent third-party certification systems (e.g., DGNB, ECORE). If certain criteria defined by the third-party certification systems in relation to the EU-Taxonomy are met, an independent certification of compliance is issued for the building or portfolio. This allows an owner to determine, for example, whether the property fits into his sustainable real estate portfolio.

Conclusion

The EU-Taxonomy is part of the European Green Deal which aims to make the EU climate neutral by 2050. The requirements defined in the EU-Taxonomy provide clear criteria for the transition to climate-neutral and sustainable real estate and buildings sector. The EU-Taxonomy aims to increase the volume of green investments in order to achieve the objectives of the European Green Deal.

Are you a building owner or developing a project and do not know if your building meets the requirements of EU-Taxonomy?

Baumann Consulting can assist you in collecting and documenting the necessary data and submitting your project to third-party providers for review. In addition, we can assist with ESG rating and certification systems.